Global factory robot installations reach second-highest level in 2024 - IFR

The US accounted for 68% of regional installations with 34,200 units, down 9%. India posted growth with 9,100 units installed, up 7%.

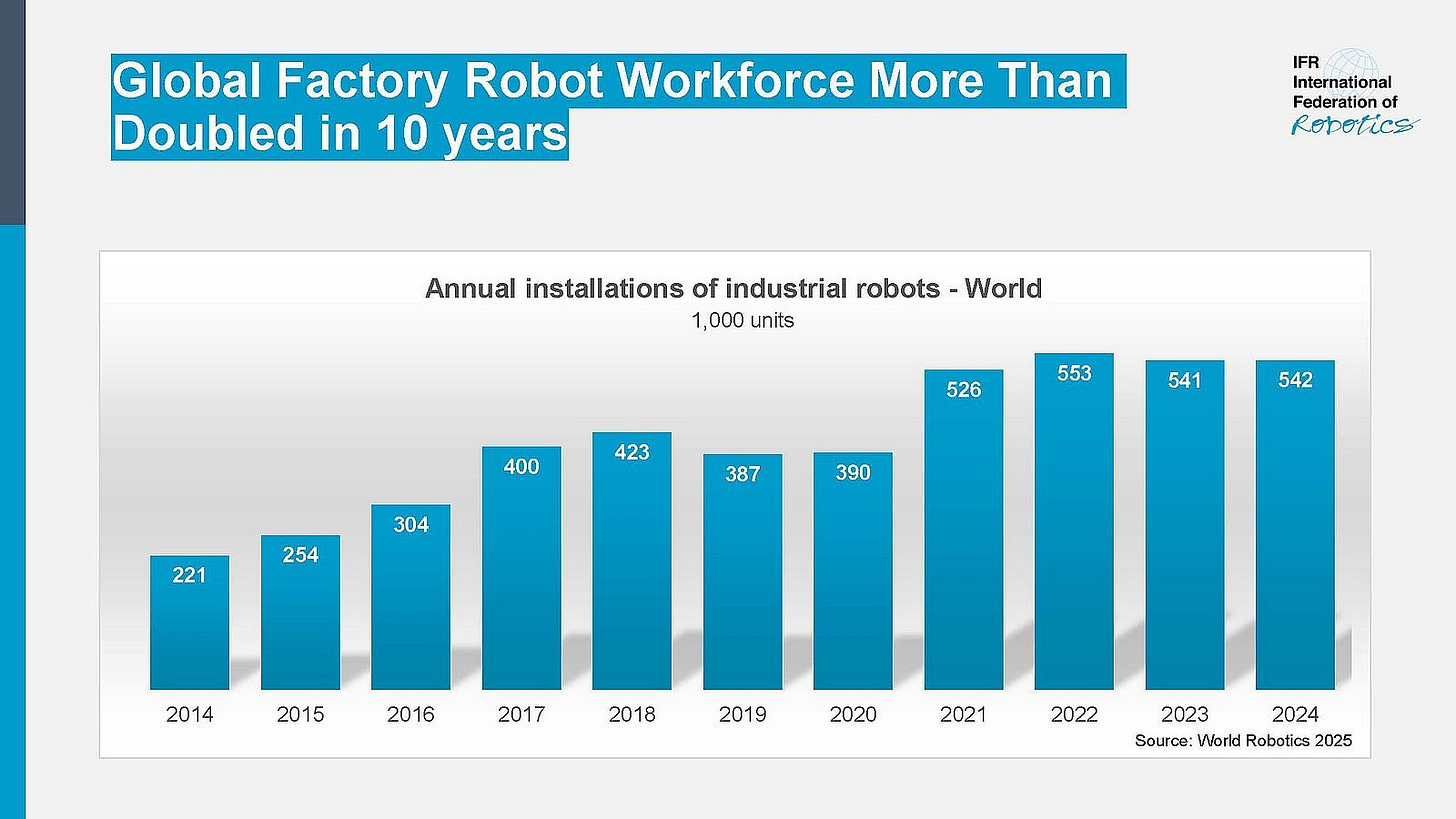

Industrial robot installations reached 4.66 million units worldwide in 2024, marking a 9% increase from the previous year and the second-highest annual count on record, according to new data from the International Federation of Robotics.

The figures represent only a 2% decline from the all-time peak recorded two years prior, indicating sustained demand for factory automation despite global economic headwinds.

China maintained its position as the world’s largest market, accounting for 54% of global deployments with 295,000 units installed—a record for the country. Chinese manufacturers achieved a significant milestone by capturing 57% of their domestic market share, up from approximately 28% over the past decade and marking the first time domestic suppliers outsold foreign competitors at home.

The country’s operational robot stock surpassed 2 million units, exceeding any other nation. Officials project average annual growth of 10% through 2028.

Japan remained the second-largest market with 44,500 installations, down 4% year-over-year, while its operational stock increased 3% to 450,500 units. South Korea installed 30,600 units, declining 3% in a market that has remained relatively flat since 2019.

European installations fell 8% to 85,000 units, with Germany leading regional demand at 26,982 units despite a 5% decline. Italy recorded 8,783 installations, down 16%, while Spain moved to third position with 5,100 units driven by automotive demand.

The Americas saw installations exceed 50,000 units for the fourth consecutive year, reaching 50,100 despite a 10% decrease. The United States accounted for 68% of regional installations with 34,200 units, down 9%.

India posted growth with 9,100 units installed, up 7%, with automotive applications representing 45% of demand. The country now ranks sixth globally in annual installations.

The IFR forecasts global installations will grow 6% to 575,000 units in 2025, with projections indicating the industry will surpass 700,000 units by 2028. Regional trends vary, but aggregate global trajectory remains upward despite geopolitical tensions and trade disruptions affecting broader economic conditions.