Self-reconfigurable robots move from lab curiosity to automation platform

The trend reflects the positioning of modular platforms as a hedge against both downtime and design lock-in.

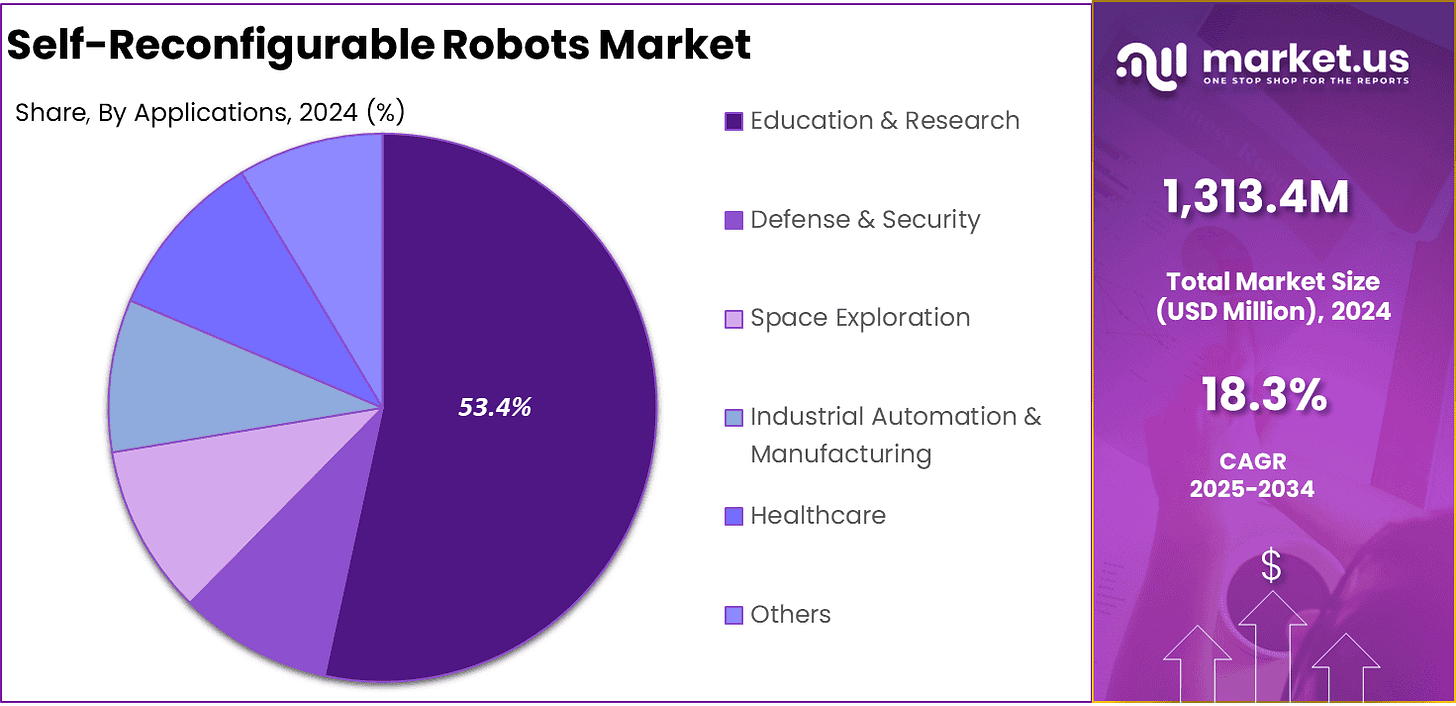

A new market study, from Market.Us, suggests that self-reconfigurable robots are shifting from research curiosities to a serious pillar of next-generation automation, with revenue projected to grow from $1.31 billion in 2024 to about $7.05 billion by 2034 at an annual clip of 18.3 percent. The numbers hint at more than a niche: modular robots are being framed as a way to hedge against technological and demand uncertainty in factories, labs and even space programmes.

The first signal is who is buying. Education and research account for more than half of current demand, reflecting the technology’s roots in universities and publicly funded labs, yet the report points to rising use in industrial automation, inspection and hazardous environments. That mix matters: academic deployment underwrites the core hardware and algorithms, while early industrial pilots test business cases around multi-task platforms, higher asset utilisation and lower maintenance downtime.

The second signal is where the power sits in the value chain. Homogeneous modular robots command around 71.8 power of the market, suggesting that users still prefer simple, repeatable building blocks over exotic heterogeneous systems. Chain-based architectures, with 45.3 percent share, map neatly onto near-term applications such as climbing, confined-space inspection and loco-manipulation tasks that conventional arms or mobile bases struggle to handle.

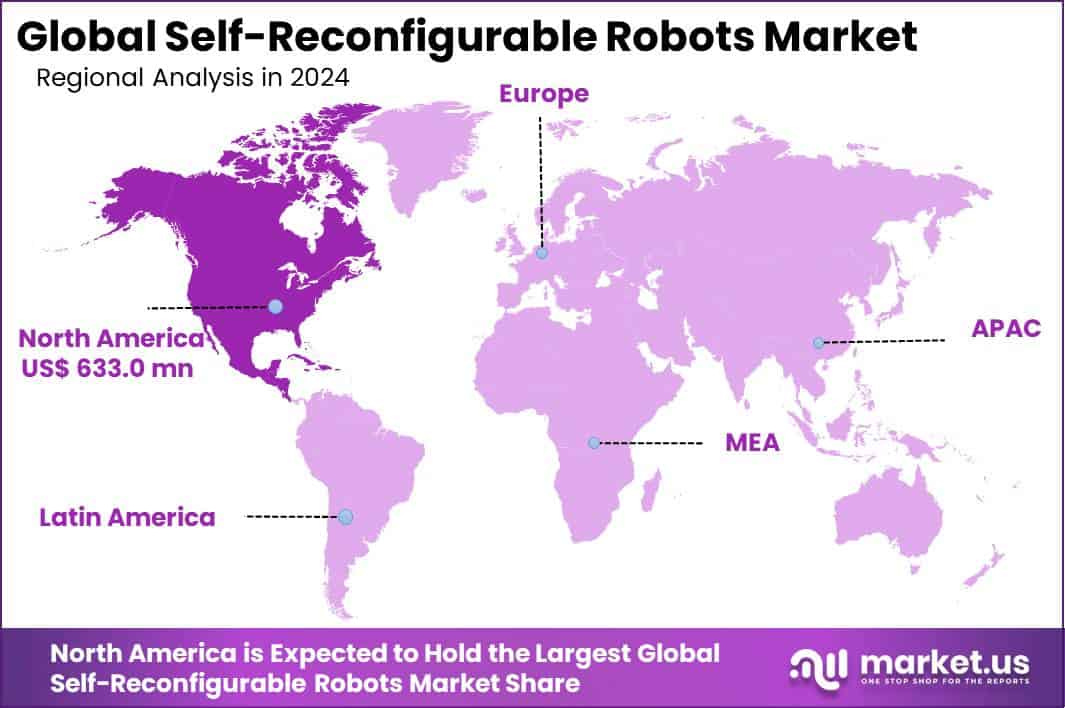

Geography reinforces the pattern. North America holds just over 48 percent of global revenue, buoyed by research-heavy ecosystems and collaborations such as HEBI Robotics’ modular “inchworm” systems and Boston Dynamics’ work with Toyota Research Institute on large behaviour models for adaptive manipulation.

For now, that concentration keeps technical know-how and early standards formation in a handful of hubs, even as Asia and Europe build their own programmes in space exploration, manufacturing and education.

Strategically, the most important claims are economic and organisational rather than technological. The report cites productivity gains of 15–25 percent in multi-task environments and the ability to keep operating after losing up to a quarter of the modules, positioning modular platforms as a hedge against both downtime and design lock-in.

Robots-as-a-service models from companies such as KUKA, together with NASA-backed modular blocks from HEBI and furniture-building swarms from Roombots, frame reconfigurability as a service layer rather than a one-off capital purchase.

Plenty could still slow the transition. The need for robust connectors, power transfer and coordination pushes up costs, and the lack of common module and protocol standards threatens fragmentation. Yet as distributed control, docking mechanisms and AI planning improve, self-reconfigurable robots look less like an esoteric research topic and more like an operating system for physical work in factories, cities and off-world projects alike.